Network effects in your mobile app portfolio (Part 2: modeling)

This is a follow up to Part 1. As discussed in the previous post, smart app developers think about maximizing their portfolio ROI, not just their individual apps’ ROI. Below is a methodology that outlines one way to think about network effects and the synergies that can lead to better asset allocation.

Gaming companies build multiple apps at a time. Each individual game can generate ROI from its own user base, but maximizing ROI for the company as a whole is more important than maximizing any individual app.

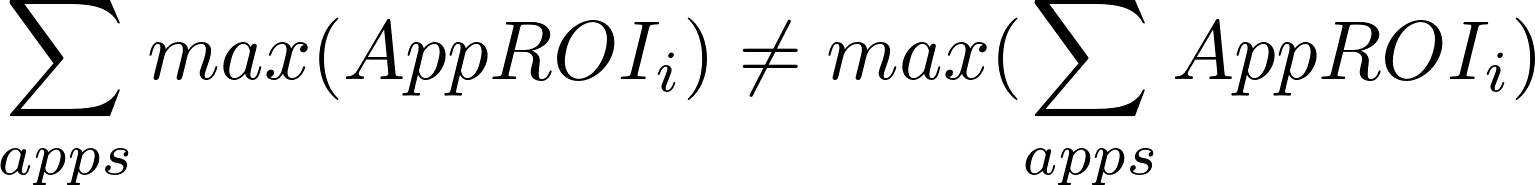

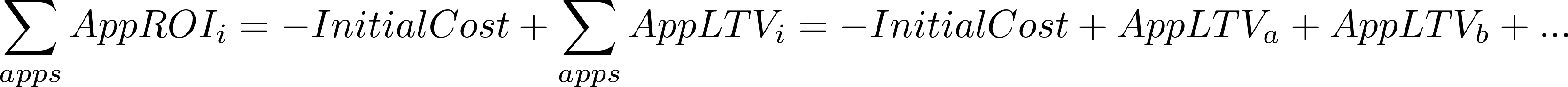

The maximization of each individual apps’ ROI is not the same as maximizing the ROI of the portfolio. Said mathematically:

The intuition behind this is simple: maximizing a single app is not going to account for synergies across the apps.

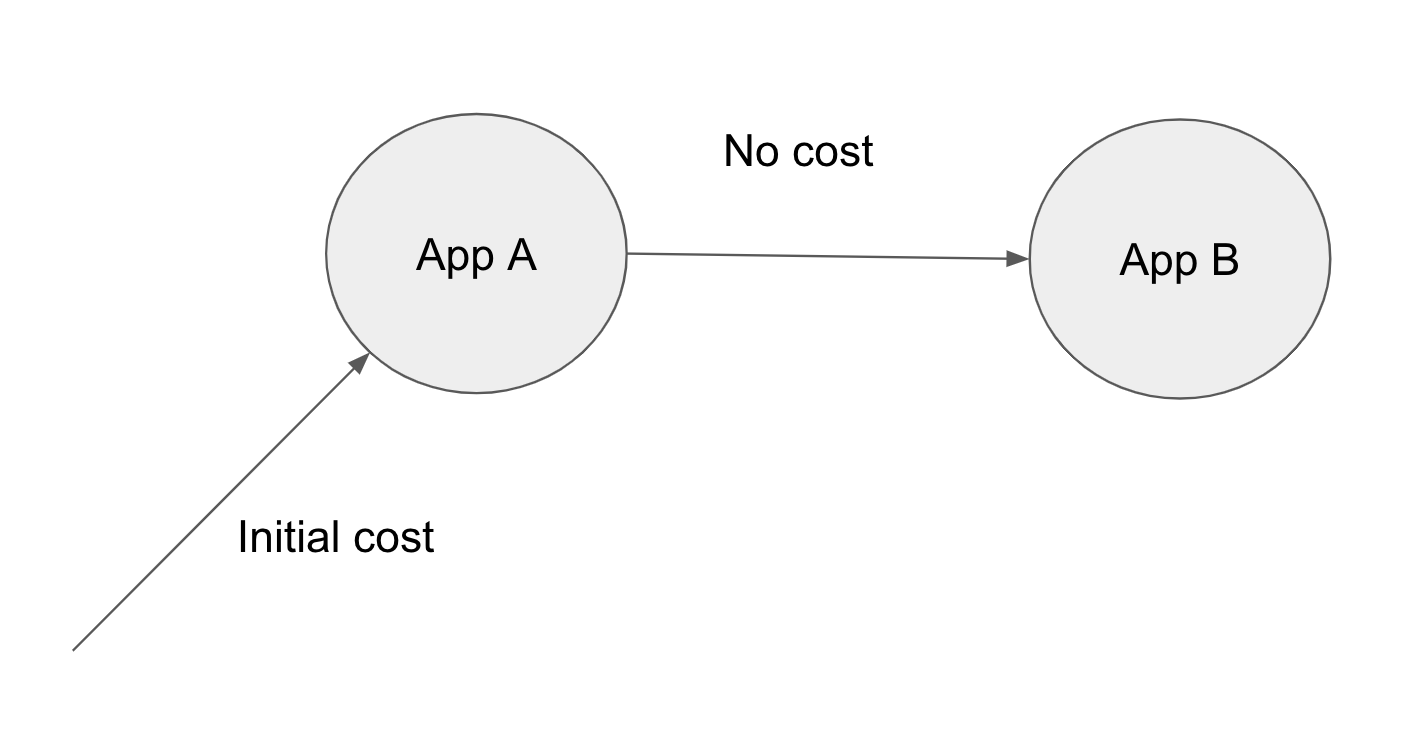

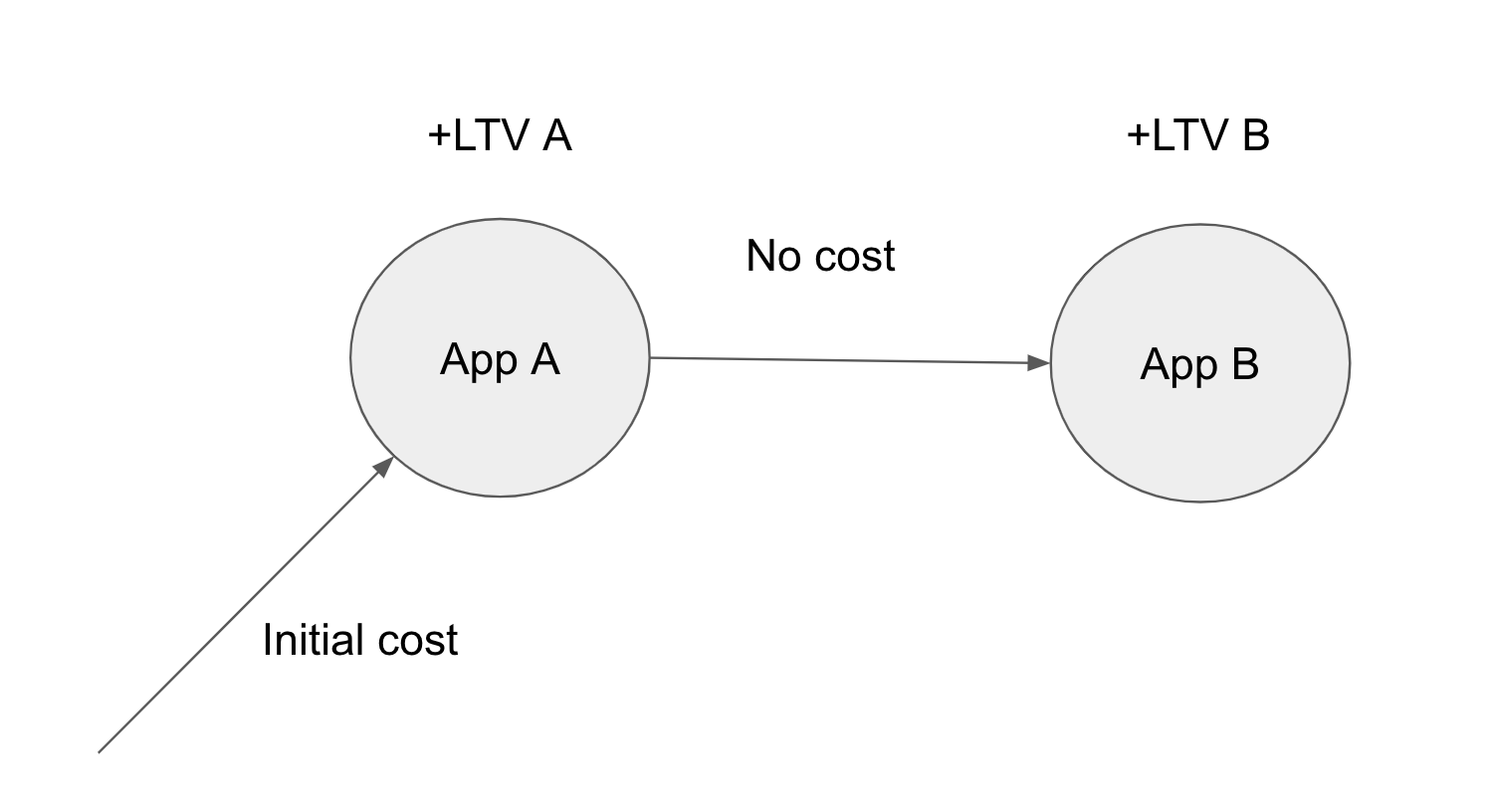

Analytically we start with observing the path of the user getting acquired (with initial cost) in AppA and then eventually moving them to AppB for free.

This shows the path of the user when there is a promotion from AppA to AppB. With LTV calculated in the movement, you can see that individually looking at AppA LTV is not the full effect of the user moving for free across both apps.

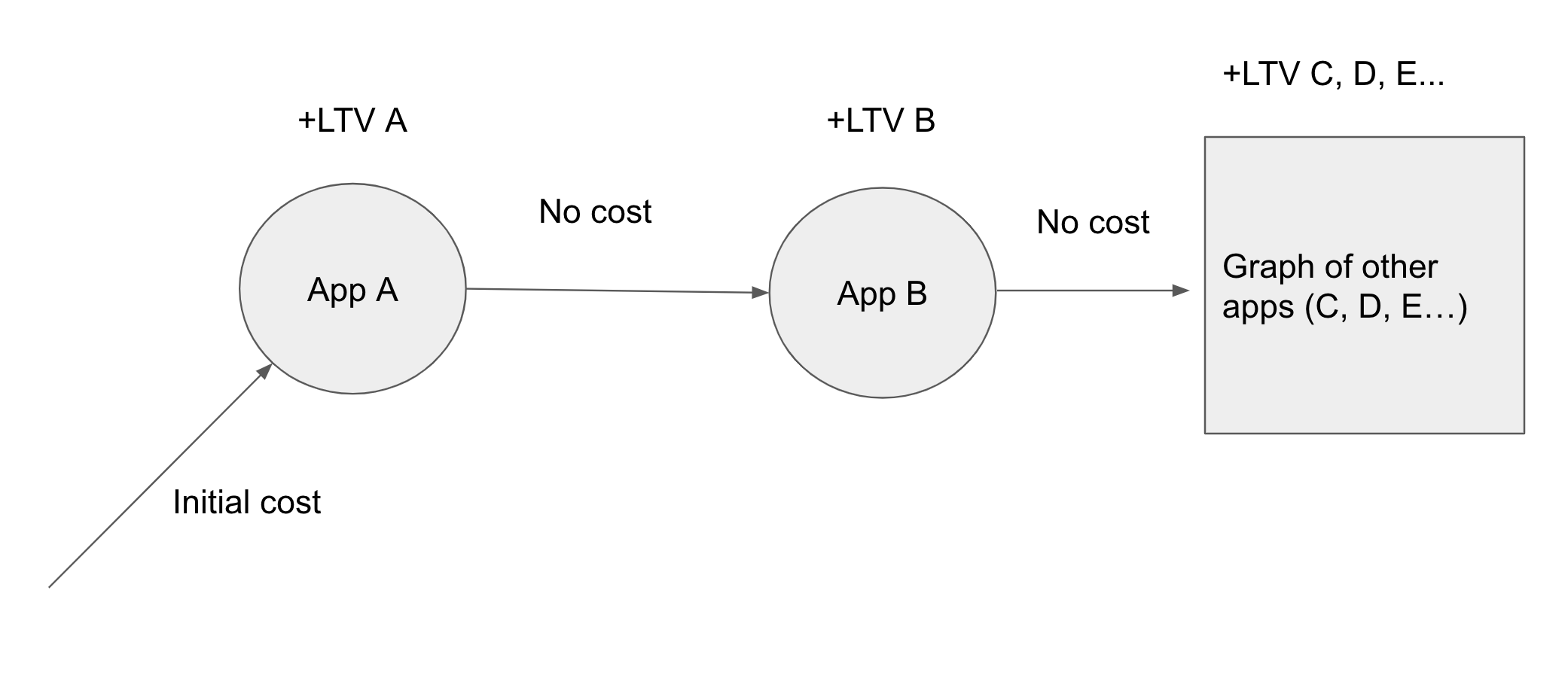

If you carry this out to infinity the graph starts to look more like this:

Using this as the underlying user model, the maximized ROI of the portfolio is simply the sum of all the LTV of each user as they go through each app minus the initial cost of acquiring the user for AppA.

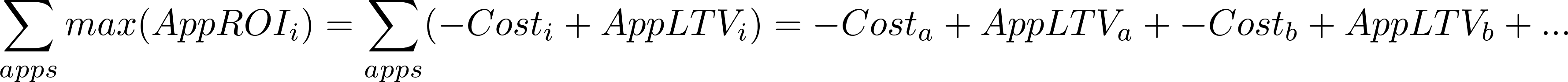

You’ll notice that this is significantly different than if you maximized the ROI on each app individually. If you acquired a user for each app individually, there would be an associated cost for each App as such:

As a result, you can see that this is the primary difference in the equations that we started with. When individually maximizing the ROI of an app by acquiring users from networks, you inherently multiply the costs that come from acquisition. When utilizing the portfolio to acquire users for free, you realize synergies in owning multiple apps and can use that to maximize ROI in a different way.

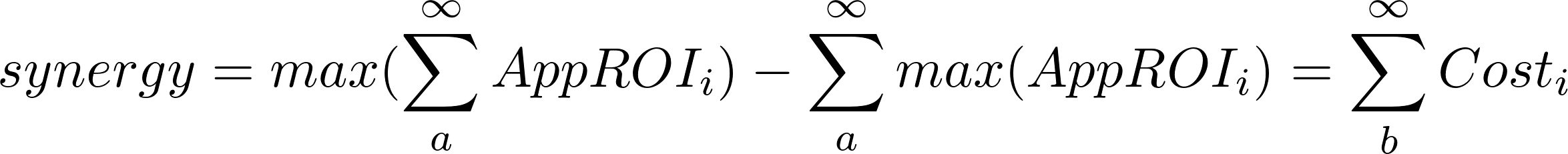

Looking at the difference between the equations would give you the resulting synergy that you get through a cross promotion strategy in your portfolio:

This is a first order model of understanding the synergy that can be saved. It makes a few unrealistic assumptions that we will eventually dispose of:

- Cross promoting as soon as lifetime ends (Cost of cannibalism = $0)

- Users acquired are paid for in all cases (CAC > $0)

- Users that are cross-promoted for free don’t have an opportunity cost (opportunity cost = $0)

- All users that are shown a cross-promotion ad install the next app (install rate = 100%)

- Paths for each acquisition and cross-promotion have no effect on the maximized ROI (Only one path for cross promotion in network)

In future posts we can talk about other more plausible models that can be derived from the basics here.