UA during COVID

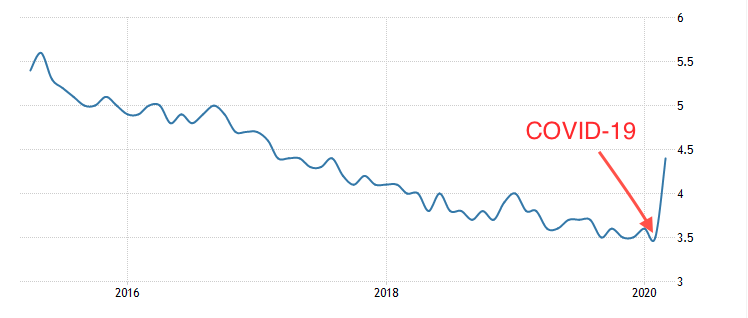

COVID-19 is decimating global unemployment and users/consumers will inevitably change their spending behavior in their mobile applications. Below is a chart of US unemployment over the last 5 years:

The data above makes it very clear when US State governments started requiring “shelter in place” provisions for its citizens. Small business owners had no choice but to furlough and layoff their employees during this mandated period so businesses could stay alive and preserve cashflow.

There are a lot more people staying at home without paychecks, so what change in consumer behavior can we expect to see?

- People will only purchase things out of necessity (think food and remote work).

- There will be a shift to more activity on BOTH necessities and FREE digital entertainment (think food, remote work, and FREE games).

- Unemployment benefits will delay these behaviors for a few months; after benefits expire, the full effect of increased unemployment will bear down on the economy.

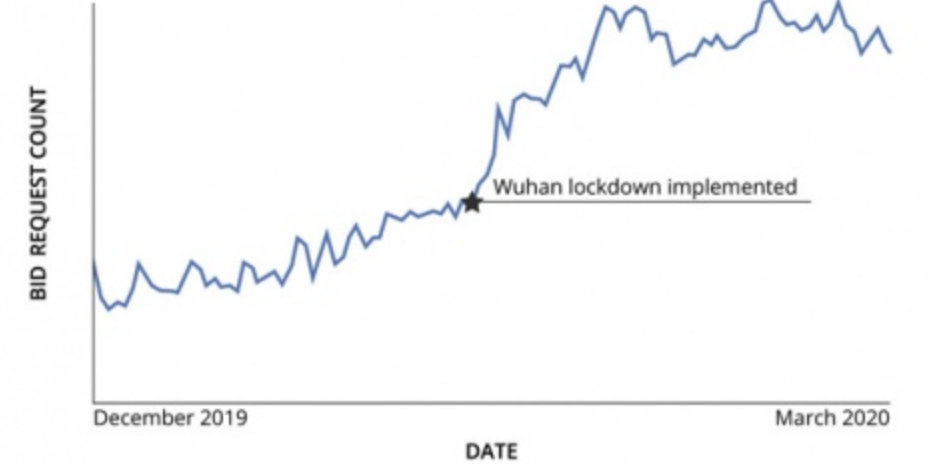

Early indicators from ad networks show these predictions taking shape. Below is a bid request chart in the last several months taken from this pgbiz article

You can see there is a lot more activity for ad inventory (bid requests) within games. As supply for ad inventory increases, prices for ad demand should decrease.

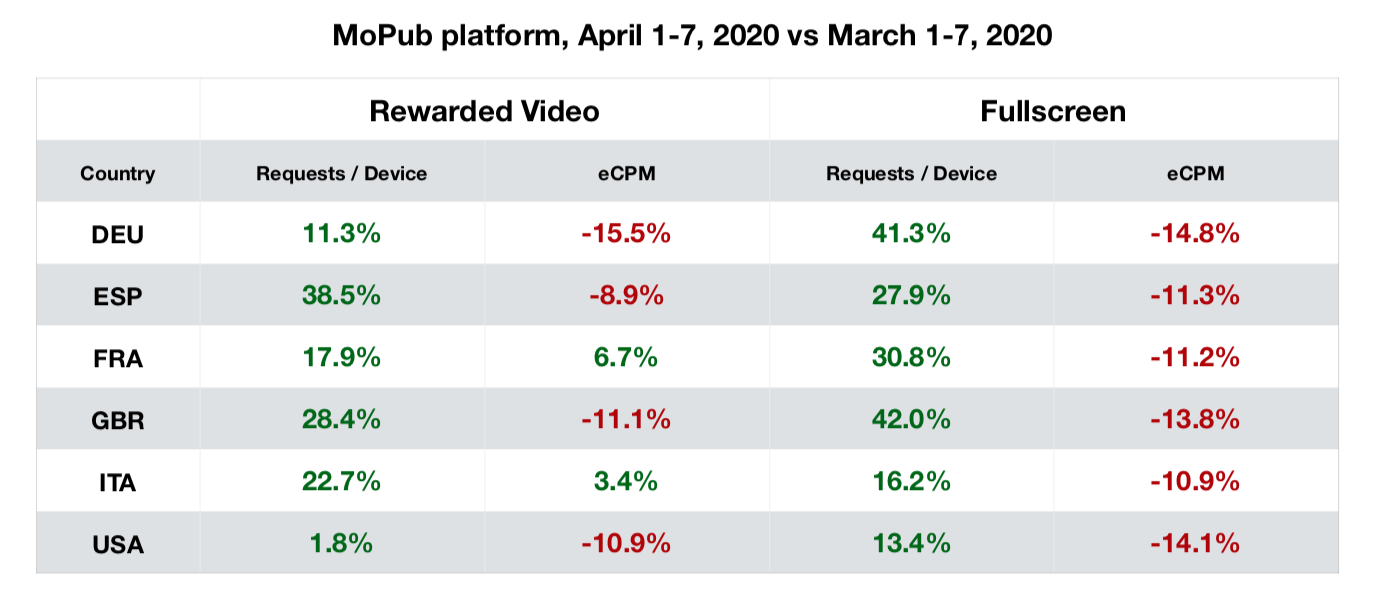

Below is illustrates the price decrease clearly (taken from Mopub April 15, 2020). Increasing device requests result in lowering eCPMs.

In the context of people staying home, this makes a lot of sense. People are unemployed and playing more games (because they can’t go outside).

Will consumer spending ever come back?

As unemployment approaches 20%, it will be a long time before people get disposable income again. Businesses need to reconcile their debts, hire people, and find their footing before unemployment comes back down. When humanity finds a vaccine, I think we could be close to “normal” within 12-18 months from that point.

During this time, more people will engage more with free to play games on their couches, but marketers will see IAP based LTVs for these free to play games come down on average per user. These new COVID-era users view IAPs as luxury goods: it’s not necessary pay to play.

Is there an opportunity during this period?

With marketers and game developers scrutinizing their advertising budgets from users with lower than average pre-COVID LTVs, industry costs for advertising (CPIs and eCPMs) will also come down 20-30%. This drop comes from less advertising demand (marketers see lower per user LTVs) and expansion of inventory (people play more games) at the same time.

This leaves opportunities for apps who have good economics to buy users at a “discount”. If you find the right niche of users who continue to spend money, you’ll be able to get them at a 20-30% discount during the COVID lockdown. As with any downturn, there are opportunities for some businesses to come out stronger than they were before.