Platform vs Ad Network IPO valuations

Mobile adtech is having a moment in the financial markets because of the recent IPO and M&A activity in the space.

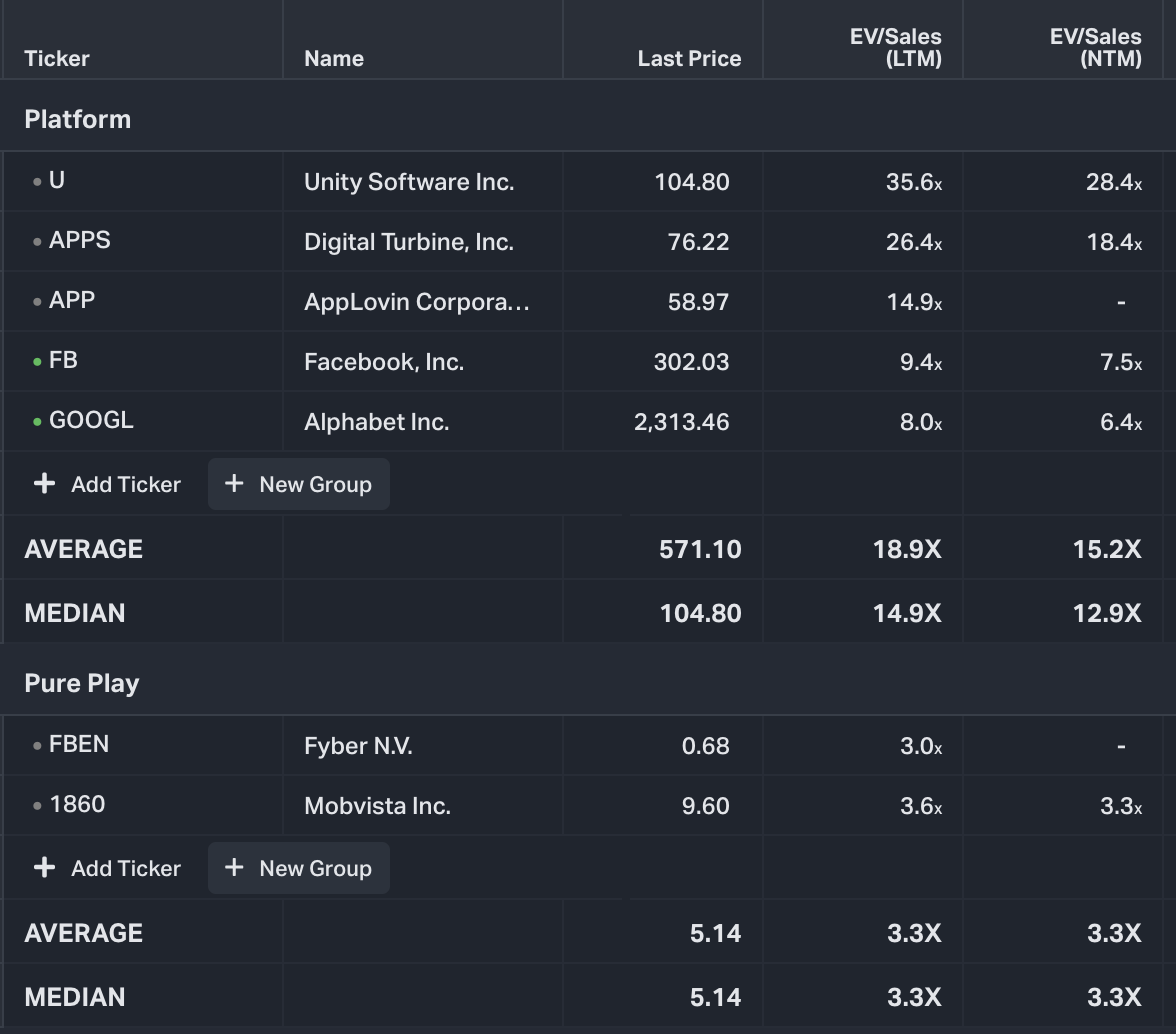

Publicly traded sales multiples

Upcoming IPO and past M&A activity

IPO activity:

- Ironsource (Will merge with a SPAC) Rumored ~11x LTM Sales

- InMobi (Will IPO later half of the year) Rumored ~10x LTM Sales

M&A activity:

- Digital Turbine bought Fyber (source) Still publicly traded

- Applovin bought Adjust (source) Rumored ~8-10x LTM Sales

- Update: Zynga bought Chartboost (source)

- Update: Mobvista bought Reyun (source)

Commentary

The financial markets are generalizing companies into two main categories: “Ad Network Platforms” & “3rd Party Ad Networks”. Ad Network Platform companies augment their adtech stacks with other core offerings or products, whereas 3rd Party Ad Networks exist solely to help act as the middle man to distribute and monetize their developer apps through their SDKs.

Two recent IPOs that reside in the platform category, Unity and Applovin, use their ad networks to monetize their other core assets. Unity has a game engine that developers build games with under a single codebase. That codebase is deployed to all App Stores (Android, iOS, etc.) with a single click. The Unity Ad Network is a secondary offering that developers can easily integrate through their game engine. Applovin recently focused its attention on acquiring 1st party content in the last 2 years, using their 3rd party ad network as a distribution/monetization engine for those apps they acquire.

The Ad Network Platforms financially differ on LTM & NTM Sales multiples where the companies are all north of 8x (and those include massive companies like GOOGL and FB!) with an average LTM & NTM multiple of ~19x & ~15x respectively. The InMobi and Ironsource private deals are rumored to price around 10x LTM sales and also have similar Platform characteristics. This is drastically different than others in the 3rd Party Ad Network category like Mintegral/Mobvista and Fyber both around 3-4x Sales. One thing to note is that Fyber was acquired by Digital Turbine (probably because financial engineering expands their multiple).

The intuition behind these multiple differences is fairly simple: pure play 3rd party ad networks are perceived to have less of a moat around their technology. Most of the defensibility and growth is built around 1st party content or a fundamental core offering that goes beyond adtech technology used to monetize someone else’s content. Unity and Applovin either own the content or are built right into the value chain for developers. Investors should be looking for opportunistic 3rd Party Ad Network companies that aim to also transform into this strategy to get the benefits the Ad Network Platforms have on their financial multiples.